Climate change is expected to impact insurability in the region

Insurance Industry in the Caribbean Islands - Climate projections for the Caribbean region suggest an increase in the frequency and severity of weather events by 2050, along with rising sea levels that will heighten vulnerabilities for coastal properties, resulting in more significant risks of flooding and erosion.

A recent climate report by Moody's RMS explores how the perpetual threat of hurricanes may intensify, posing substantial risks to both infrastructure and communities. Anticipated changes in rainfall patterns may lead to increased flood risks during heavy precipitation, as well as prolonged dry spells and droughts.

When assessing potential impacts, Caribbean nations facing higher risks are expected to see a uniform increase in loss costs of over 10%. For the most vulnerable areas, like the US Virgin Islands, this increase could reach as high as 17%. These models highlight that investing in building upgrades alone could significantly lower loss costs compared to existing risk values, emphasizing the importance of investing in risk reduction and resilience-building measures.

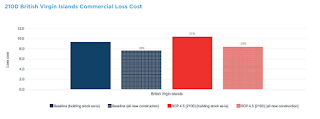

Looking towards the end of the century, protective measures aimed at mitigating risk in the built environment have the potential to limit the most severe increases in loss costs, resulting in only marginal rises from current values. On the contrary, inaction could lead to a substantial escalation in potential loss costs, reaching as much as 27% in specific scenarios, including a 19% increase for the British Virgin Islands.

The anticipated rise in future loss costs might encourage Caribbean nations to prioritize measures and innovative strategies to reduce risk and enhance resilience. These modeling studies assist governments, businesses, property owners, and communities in evaluating and prioritizing risk reduction strategies, demonstrating the financial advantages of investing in measures to prevent future losses and improve insurability.

Amidst the evolving impacts of climate change in the Caribbean, the concept of an insurability threshold becomes increasingly relevant. This threshold refers to the point at which insurance becomes either unavailable or excessively expensive due to heightened risks associated with specific events or conditions. The significance of insurability becomes more pronounced as the region faces potential loss cost increases ranging from 10% to 17%, particularly by 2050.

The report also highlights that various factors influence the availability and cost of insurance. Premiums not only reflect the anticipated frequency and severity of risks but also encompass other elements, including the expenses associated with underwriting and claims. Factors such as the current global inflationary environment, leading to increased costs for repairs, materials, and labor, contribute to the rising costs of claims. Additionally, the supply of reinsurance capital is becoming more expensive.

The sustainability of private insurance depends on insurers' ability to collect sufficient funds for their claims. Looking ahead, devising actions that aid in risk reduction can compensate for the expected rise in hazards due to climate change. Whether through increased risk-sharing or more stringent building codes, employing risk modeling can help in crafting plans for Caribbean risk trajectories, ensuring insurance sustainability for the 21st century."

Related:

- Is the Cyber Threat Landscape Underestimated by Startups - Inforia

- Promoting Awareness: The Importance of Insurers in Smart Home Tech Adoption - Inforia

- Empowering North American Clients: AXA XL Expands 'Ecosystem' Suite Access - Inforia

- Navigating Stormy Seas: P&C Sector Bracing for Significant Headwinds - Inforia

.png)

.jpg)